If you don’t understand the subtle tax and financial nuances involved in this decision, don’t worry, you’re not alone.

In Part One, we discussed what you get for your money, what you should pay up front, what you should pay per month, what you should pay in non-tax depreciation, and which tax deductions you can and should get.

Let’s now look at what happens when you get rid of the vehicle, what you pay for excess mileage and wear, how much flexibility you need, and other personal considerations.

Factor 6: What happens when you get rid of the vehicle?

If you exercise the purchase option at lease end, the tax consequences are those associated with the purchase of the previously owned vehicle; if you don’t exercise the option, you can take tax deductions for the costs of escaping from the lease.There are also non-tax financial consequences.

Buy: When you buy the vehicle, you can get rid of it any time you please. The amount of money you get for the sale or trade-in is yours to keep (or apply to the cost of a new vehicle).

Lease: When the lease expires, you can either return the vehicle or buy it for an option price set in the lease.

Weighing the options: You also pay fees when returning a leased vehicle, including charges and fees for excess mileage or damage beyond normal wear and tear—dealers often inflate these fees to pass along the risks of higher-than-expected depreciation.

Factor 7: What you pay for excess mileage

Buy: When you buy a vehicle instead of leasing, you can drive it wherever and whenever you want—there are no limits!

Lease: Leased vehicles are subject to annual mileage restrictions—generally between 12,000 and 15,000 miles. If actual mileage exceeds these limits, you must pay a fee at the end of the lease.

Weighing the options: The tax and other financial savings of leasing may be wiped out if you plan to drive the vehicle more than 15,000 miles per year. Of course, you can also negotiate for higher mileage limits, although you may have to accept a higher monthly payment in return.

Factor 8: What you pay for excessive wear

Buy: When you buy a vehicle, you can abuse it all you want. In addition to tangible financial advantages (e.g., not having to pay for damage beyond wear and tear), the freedom to ride a vehicle as hard as you want bestows psychological benefits that are hard to calculate.

Lease: You must return the vehicle without (or pay for any) serious damage beyond normal wear and tear.

Weighing the options: Although buyers don’t pay fees for it, damage to the vehicle reduces its resale/trade-in value. So there are economic incentives to keep the vehicle in good condition whether you lease or buy it.

Factor 9: Flexibility

Buy: It’s generally easier to qualify for a vehicle loan than a vehicle lease. And once you buy a vehicle, you’re free to dispose of it however and whenever you want—as long as you’re not upside down on the loan.

Lease: It’s hard to escape or modify a lease before its term expires. Dealers typically charge up to six months’ of payments in early termination penalties.

Weighing the options: You should stay away from leasing if your credit rating is low and/or you want maximum flexibility.

Factor 10: Personal considerations

Buy: Buying a vehicle is a fairly straightforward transaction, especially if you don’t finance it. And other than the service department, you generally don’t need to remain involved with the dealership unless and until you decide to buy another vehicle from it.

Lease: Leases are fairly complex transactions that can require closer contact with and, alas, greater trust in the dealer or lessor. And because leases expire, you may need to spend more “quality time” with the dealer.

Weighing the options: As a personal preference, leasing is best suited for those who:

- Don’t like the vehicle-buying experience but don’t mind dealing with dealers

- Want to get a new vehicle every few years

- Want to drive more expensive vehicles than they could otherwise afford to buy

Summing it up

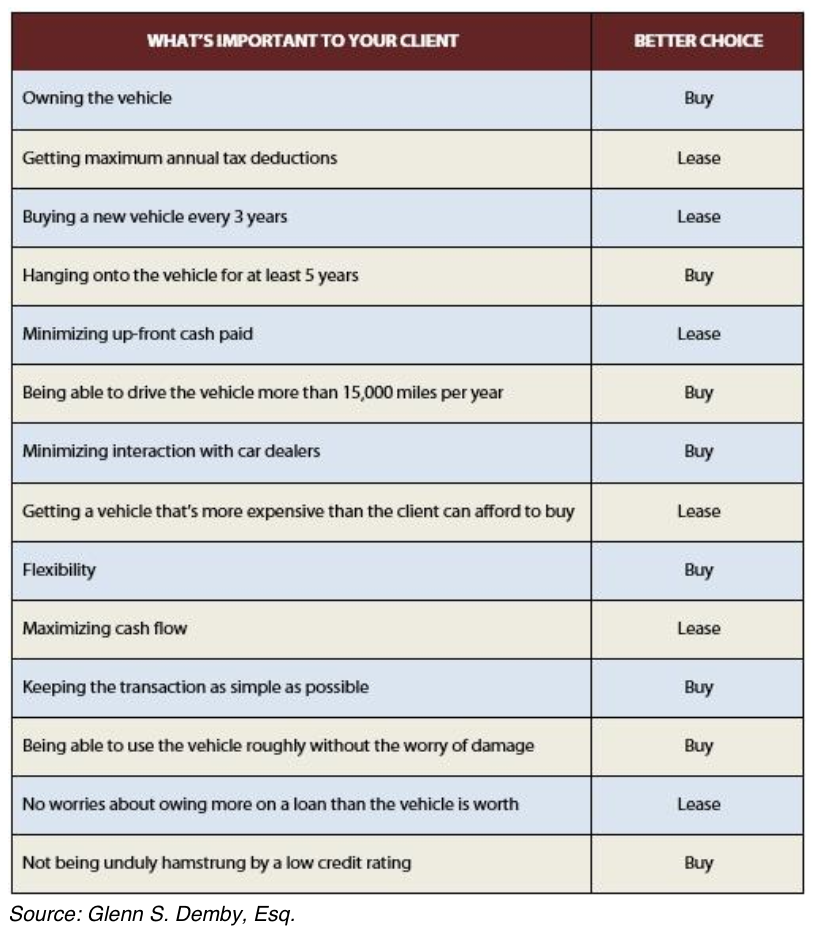

The chart below is a handy visual summary that advisors like me use to help our clients weigh key factors in the buy vs. lease decision. It’s pretty straightforward.

Need help with other business ownership questions or financial matters? We’re always here to help.