Elite wealth planning often plays a key role in the lives of today’s highly successful individuals and families—as well as those who are on the path toward great financial success.

With that in mind, here’s a closer look at just what elite wealth planning is—how it works and how it can potentially have a powerful impact on your life as you seek to build, preserve and protect your wealth.

The Key Elements of Elite Wealth Planning

Before we can see what makes elite wealth planning so special, it’s important to understand the various planning strategies that make up the core of most elite wealth planning efforts.

Typically, elite wealth planning consists of seven main types of planning:

- 1. Income tax planning focuses on mitigating taxes on money earned by working—potentially enabling you to keep more of the money you make.

- 2. Estate planning involves using legal strategies and financial products to determine the future disposition of current and projected assets. Critically, it is important to determine who will own the assets and how they will be owned.

- 3. Marital (and related relations) planning entails planning for disruptions in the relationships between spouses and other partners. The intent is to take actions that will protect your family’s wealth.

- 4. Asset protection planning entails employing legally accepted and transparent concepts, strategies and financial products that are designed to help ensure your wealth is not unjustly taken.

- 5. Charitable tax planning addresses ways to be philanthropic in the most tax-efficient manner. The tax code fosters philanthropy, and charitable planning can help maximize the impact of your giving.

- 6. Business succession planning principally deals with helping entrepreneurs tax-efficiently transition their businesses to others, whether they are family members or not.

- 7. Life management planning addresses an array of concerns from a wealth management perspective—for example, structuring wealth to deal with longevity- and health-related concerns and actions.

In practice, there can be great overlap between these areas of planning, as well as opportunities for them to work together to accomplish more than they could alone.

Some examples:

- By placing assets into an irrevocable trust for the primary purpose of transferring them to heirs—an estate planning strategy—elite wealth planning might pinpoint related strategies for protecting your assets.

- Business succession planning can be entwined with estate planning and potentially other planning specialties to support your goals in multiple areas.

Clearly, elite wealth planning is designed to help address your needs, wants and preferences across a full spectrum of planning specialties—potentially enabling you to optimally structure all the areas of your financial life.

These various types of wealth planning are not new, nor are they in any way restricted to the very wealthiest among us. Lots of people can seek help with their charitable giving, marital planning or income tax planning.

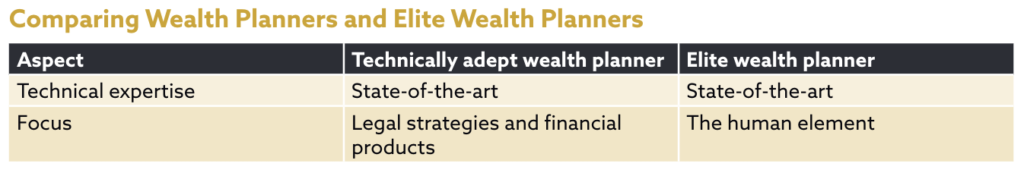

Additionally, the level of technical expertise possessed by a professional wealth manager offering wealth planning isn’t a major differentiator. Wealth managers who are “just” technically adept and elite wealth planners both can be considered state-of-the-art in terms of their expertise (see the table below). All technically skilled wealth planners should be able to deliver essentially the same menu of solutions to their clients.

But there is one key characteristic that tends to make elite wealth management so—well, elite: the focus of the particular wealth manager.

Specifically, elite wealth planners focus intently on the human element of the wealth planning process—understanding their clients on deep, personal levels that go beyond the numbers that appear on their tax returns or balance sheets.

In contrast, technically adept wealth planners are generally more focused on the legal strategies and financial products such planners can offer. This doesn’t mean that technically adept wealth planners are not concerned with interpersonal relationships with their clients and the psychology of the affluent. But from an objective standpoint, interpersonal relationships with clients are of much less concern to technically adept wealth planners than they are to elite wealth planners.

While elite wealth planning can include some highly sophisticated thinking and solutions, we strongly believe the human element is much more important. In elite wealth planning, the client—be it an individual, a business owner or a family—takes center stage in all discussions and decisions. The elite wealth planner’s technical capabilities and solutions exist only to serve the client and provide what he or she wants most as a person.

That’s why we define elite wealth management this way:

Elite wealth planning is a comprehensive planning process that incorporates state-of-the-art technical expertise in legal strategies and financial products with the human element.

Unfortunately, the human dynamic is often overshadowed by legal and financial expertise. To get truly meaningful results, a wealth planner must be acutely attuned to both the rational side and the emotional side of a person—the logical and the illogical. It’s this awareness of and sensitivity and responsiveness to the human element that we firmly believe makes wealth planning elite.

Bonus Takeaway:

The comprehensive process at the core of elite wealth planning enables both the wealth planner and the client to reveal more about themselves (including the way they like to work, their aspirations and even their limitations). Along the way, elite wealth planning creates a level of security and comfort that is the foundation of a rewarding relationship.

Capital Developers, LLC dba Milestone Wealth Information is registered as an investment adviser and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators and does not mean that the adviser has attained a particular level of skill or ability.

All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. Content should not be viewed as personalized investment advice or as an offer to buy or sell any securities discussed. A professional adviser should be consulted before implementing any of the strategies presented. All investment strategies have the potential for profit or loss. Content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. The firm is not engaged in the practice of law or accounting.This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.