If you decide to sell your business, you’ll likely encounter two main types of buyers: financial and strategic.

Each type has its own intentions for wanting to buy your business. When you understand what drives and motivates each type, you can potentially maximize your ability to get the best deal terms based on your objectives—including the price you get for your company.

With that in mind, here’s a look at the world of strategic buyers and financial buyers.

Financial Buyers: It’s All About the Numbers

Financial buyers are professional investors who are in the business of buying and selling companies. They are solely interested in getting a financial return by purchasing a company. That return usually comes in two forms:

- Funds taken out from cash flow

- A future sale of the company

In short, it’s all about the return on investment. That means you’ll probably find that a financial buyer will be willing to pay more if you can make a compelling case that your company will generate strong and reliable profits for years to come.

Buying and then reselling a company is the most common way for financial buyers to profit, so financial buyers tend to be opportunistic. They generally search for undervalued companies—like most investors, they seek to buy low and sell high down the road. They also seek companies with significant growth potential (based on the industry they’re in, their location or some other growth driver).

Usually, but not always, financial buyers have deep knowledge about a particular industry or type of business and concentrate their activity in a single area. Example: A financial buyer might focus exclusively on acquiring retail-oriented companies, or go even deeper by buying only apparel retailers.

Your role: Financial buyers see your business as an investment—not as a hands-on enterprise to run themselves. Therefore, they will likely expect you (and some of your team) to remain active in the business after the sale—so you can keep generating those expected big profits.

Financial buyers commonly inject capital into the businesses they buy—potentially giving you (assuming you remain at the helm) greater opportunities to pursue initiatives aimed at driving stronger growth. They also regularly engage in financial restructuring in order to boost the value of the companies they buy—taking actions such as reducing expenses and using debt to expand the businesses.

Financial buyers regularly use a substantial amount of leverage when purchasing companies, which can result in the lenders acting as partners in the purchase. When debt is used, the objective is to use operating profits to pay the interest.

There are generally two distinct types of financial buyers: private equity firms and family offices. The vast majority are private equity firms that tend to be quite knowledgeable and sophisticated when it comes to the many aspects of deal making (including due diligence, valuations, legal expertise about acquisitions, and deal structuring).

That said, family offices are increasingly purchasing (or investing in) privately held companies. Entrepreneurship is how many families with family offices became extremely wealthy in the first place, so buying existing businesses is often seen as a natural way to generate additional wealth. As with private equity firms, most family offices have extensive expertise in doing deals.

Strategic Buyers: Building Value through Synergies

In contrast to financial buyers, strategic buyers are typically focused on how acquisitions can complement and enhance their existing business or businesses. For strategic buyers, the logic behind a purchase is:

1 already-owned business + 1 newly acquired business = the power of 3 businesses

In other words, the value of the combined company is greater than the values of the individual companies operating on their own. This is called synergy.

This additional value can be created in several ways, most commonly including:

- Access to new markets

- Expanded product lines

- Increased talent

- Greater cost efficiencies due to the elimination of redundancies

- New capabilities (such as enhanced distribution or intellectual property)

- A more powerful brand and reputation

Strategic buyers are often larger firms that evaluate a business based on what it could be worth if they were at its wheel making the decisions. As such, strategic buyers will often pay more for a company than will financial buyers, because of the enhanced value they expect to derive from the synergies fueled by the acquisition.

For strategic buyers, it is less expensive and faster to acquire an existing company and benefit from the synergies than to build the capabilities from scratch.

There are two main types of synergies:

- Reliable synergies that have a high likelihood of increasing company efficiencies and profitability. These types of synergies are often easier to quantify (and thus more likely to contribute to a higher price).

- Potential synergies that may lead to greater corporate capabilities and growth. These synergies can be more nebulous, and may or may not be major factors in the price of the company.

The more likely the synergies, the more valuable your company will be to the strategic acquirer. The better your ability to identify and make the case for a broad range of synergies, the higher the sale price you’ll likely get.

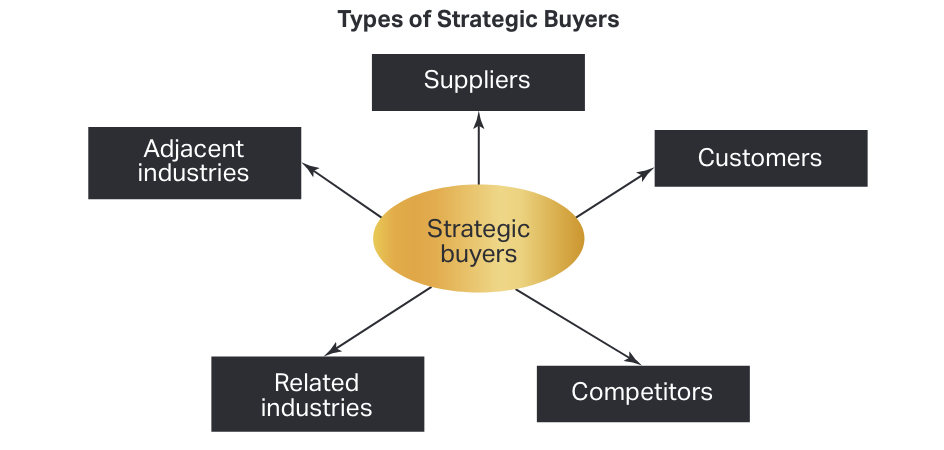

The types of strategic buyers are many and varied. They include:

- Suppliers possibly looking for vertical integration

- Customers looking for vertical integration

- Competitors seeking to benefit from industry consolidation

- Companies in related industries looking to diversify

- Businesses in adjacent industries selling similar products

Guidelines for Choosing Your Buyer

Which is better—a financial buyer or a strategic buyer? The answer, of course, is that it all depends on your goals and objectives. But here are some guidelines to help you arrive at the right decision for you.

Strongly consider a financial buyer if:

- You seek access to capital for growth and acquisitions.

- You value flexible deal terms and transaction structures.

- You want to continue to be actively involved in the company, post-deal

Think twice about a financial buyer if:

- You don’t want to take on additional debt payments (which can be considerable).

- You want to exit the business entirely.

- You dislike the idea of the buyer exerting extensive financial influence on the business.

Strongly consider a strategic buyer if:

- You seek the highest valuation for your company.

- You no longer want to be involved in the company’s management, post-sale.

- You want synergies between the two companies in order to increase the overall success of the combined business.

Think twice about a strategic buyer if:

- You fear the potential synergies will not be realized and the company will suffer.

- You worry that the sale would hurt morale among employees.

- You think customers may have negative reactions to the sale.

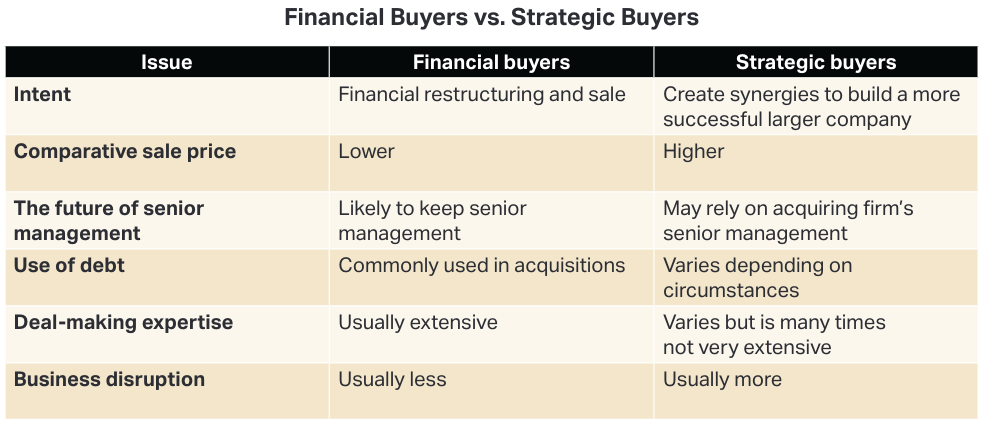

This chart summarizes financial and strategic buyers on a number of key issues. By understanding the differences, you may be better able to make a more informed decision that reflects the goals and priorities you have for yourself and your company.

Conclusion & Next Steps

When you sell your company, you’ve got one chance to get it right—there are no do-overs. Thinking ahead about to whom you want to sell can set the stage for much of the rest of the journey—and potentially enable you to get the specific results you care about most.

For more advice on selling your business or a second opinion on your financial future, please use our online calendar to schedule an appointment convenient for you.