How to live the life you always wanted and ensure that your business provides the income you need for your post-exit retirement lifestyle

Key Takeaways

- What if your business is not worth what you think it is?

- Do you know why having 80-percent of your assets tied up in your business is risky?

- How confident are you about your plan for exiting your business and supporting your lifestyle post-exit?

Read on for answers to these and other concerns of successful business owners, like you.

Growing up on a farm in Illinois, I participated in the 4H and FFA programs and majored in Ag Business in college. While I ultimately did not follow my dad and older brother into the family business, farming taught me a lot about the value of hard work and overcoming adversity. It also taught me a lot about making my money work for me.

When I was 12, I showed a steer at the county fair and sold the steer at auction for $1,500. I was thrilled. That was a ton of money at the time and I was tempted to spend it. Fortunately, my dad took me to see his financial advisor and we invested the money into a mutual fund. I couldn’t get my hands on the money, but I enjoyed reviewing the quarterly statements with my dad. Over time the account balance went up. I asked my dad such questions as; “What is a stock?”, “What are shares?”, “How do you make money?” and occasionally, “Why is my mutual fund down?”

After watching my $1,500 grow over the years, I started to understand the power of long-term investing. Farming, like investing, requires you to be patient, ride out the storms and keep the big picture in mind as the seeds you plant begin to grow.

Like farmers, business owners are extremely busy people who never shy away from hard work or long hours. When you’re starting your venture, it’s tempting to do all the “chores” yourself–accounting, hiring, operations, sales, marketing, maybe even the technology. But that’s not sustainable as you get bigger and more complex. You can no longer be a do-it-yourselfer with your finances either.

How will you know what your business is worth?

Unlike publicly traded companies which have efficiently traded liquid securities, privately held businesses are illiquid. Most business owners think that selling their enterprise is like selling their house. Simply hire an agent and then find a ready buyer. Sounds pretty simple, but just as there are barriers to entry when starting a business, there are “barriers to exit” when selling a business. Among those barriers are illiquid, privately held stock, lack of ready buyers, huge dependency on the founder/owner. Also, many business owners do not share information readily with anyone outside of their inner circle and the business is typically the owner’s largest personal asset—by far.

Most business owners view their companies and their roles within those businesses as their job. Sound familiar? However, people who are considering buying your business look at it simply as an investment of their capital. As an owner, you can’t personalize your business if you really want to sell it successfully. You need to step away and start thinking more like an investor and less like an owner. That being said, the decision to sell your business (i.e. an illiquid investment that you’ve worked so hard to build) is both a personal and business consideration. The key is to devote at least two years, preferably five, to make the transition from the business being personally dependent on you to making the business independent and transferrable.

How do you solve the diversification problem?

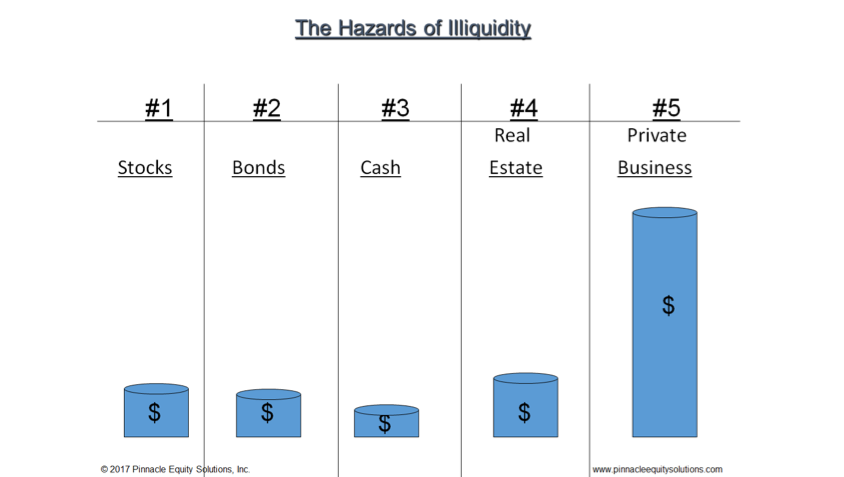

A study by Mercer Capital found that many business owners have 80 percent or more of their personal assets tied up in their businesses. That’s way too much of what we call “concentration risk” (i.e. putting too many of your eggs in just one basket). As I discuss later in this article, over-concentration can also result in an underfunded retirement when the big payout you are expecting when you sell your business never materializes. As the chart below illustrates, owners typically invest in most of the major asset classes that mainstream investors do, but again, their business accounts for the vast majority of their net worth.

As mentioned earlier, your business may be the best performing of the assets you own, but it also makes you highly vulnerable to concentration risk. While concentration of one high performing asset is great during the accumulation phase of your life, it is not the best option for the distribution phase of your life (i.e. your retirement years). In retirement, your No.1 goal is to reduce your risk (i.e. volatility) while creating a plan to increase your income to combat inflation. Selling your business enables you to diversify properly and it provides liquidity to create that income stream.

What steps can I take now to change my fortunes?

I’m guessing that one of the first professionals you hired was a good local CPA or tax professional. Chances are you are still with that CPA today. If you’re like most driven entrepreneurs, you keep a laser focus on business operations while the CPA takes care of the taxes and everything else related to the financials of your business.

That makes you a responsible taxpayer, but not necessarily a savvy business owner.

For example, I know the owner of a local construction business pretty well. After years of struggling, the business is finally gaining traction and now generates over $1.5 million in annual revenue. The owner is pulling down $300,000 a year for himself before taxes. Not a bad income in most parts of the country and he is putting away $2,000 per month ($24,000 a year) into his company retirement plan. The owner feels good about that amount since he’s funding his retirement nest egg and still has plenty left over to upgrade his home and reward his spouse and children who supported him through the lean startup years. The owner is also able to honor the increasing number of charitable requests he receives.

While the average American would be thrilled to sock away $24,000 a year into a retirement plan, that’s not much for someone earning $300,000 per year. At that income level, the owner should be putting at least $1,000 to $2,000 per month more into his retirement fund—equities with some bonds, depending on his risk tolerance, stage of life and retirement goals.

If you’re a business owner, there’s another reason that you should be socking away more into your retirement nest egg. The big payout you’re hoping to receive when you finally sell your business may never come—or it may come in the form of an offer that’s much lower than you expected. As I discussed earlier, research shows that many business owners have 80 percent or more of their personal assets tied up in their business, leaving them more vulnerable to both concentration risk and an underfunded retirement. Sadly, this scenario plays out all too often because business owners tend to value their companies based on how much blood, sweat and personal assets they’ve put into their ventures—not on what a rational buyer is willing to pay for the business.

Why is it important to get a complimentary Second Opinion Service

A survey conducted by AES Nation, LLC found that 78.6% of successful business owners have hired less-than-capable advisors. When this is the case it is more important than ever for you to determine if you are on the right track. At Milestone Wealth we provide a complimentary benefit called our Second Opinion Service.

After two meetings, we’ll provide a detailed analysis ($5,000 value) that will confirm one of three things:

- You’re on the right track with your current advisor and plan.

- You have gaps in your plan, but we’re not the fit for you and we’ll refer you to someone who is.

- You have some holes, and we do think we’re the right firm to help you fill those holes and bridge those gaps in your plan.

89.7% of business owners found the personal financial second opinion service valuable vs. 65.7% who found a medical second opinion valuable (AES Nation, LLC). Contact us to schedule a time to determine if you are on the right track to your retirement goals.

About the Author

Dave Hunt, CFP®, AAMS® is a Wealth Manager with Milestone Wealth in Greenville, NC. 252.756.7005 www.milestonewealthusa.com

Capital Developers, LLC dba Milestone Wealth Information is registered as an investment adviser and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators and does not mean that the adviser has attained a particular level of skill or ability.

All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. Content should not be viewed as personalized investment advice or as an offer to buy or sell the securities discussed. A professional adviser should be consulted before implementing any of the strategies presented. Content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. The firm is not engaged in the practice of law or accounting.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio.