For so many of us, family is paramount. You probably expect to use your wealth to take care of your family in the here and now—health care, travel, college tuition and the like. But chances are you haven’t thought nearly as much about positioning your assets so they’re ready and able to help the people you love after you’re gone.

Even if you have made some headway in this area, your plan for your estate is probably a little—and maybe a lot—out of date.

If that describes your situation, don’t fret. Even if you have many moving parts to your finances, you can get on track by focusing on two main areas of estate planning: wills and trusts. Here’s how to do it.

Where there’s a will, there’s a way

Read this next sentence three times in a row: Everyone should have a will.

Got it? A will should be the basic foundation of every estate plan—the starting point for a well-conceived strategy to transfer assets at death. A will identifies precisely what you want to have happen to your assets and estate. Dying without a will means you have decided that the state knows what’s best for you and your family. In addition, dying without a will means you want to make the settling of your estate as difficult, as costly and as public as possible.

As with any decision, there are both positives and negatives to a will. That said, we strongly believe the benefits of writing a will far outweigh the drawbacks.

Advantages:

- You decide on the disposition of your hard-earned wealth.

- Estate taxes are mitigated—especially when the will is part of a broader estateplan.

- You specify who the fiduciaries will be.

Disadvantages:

- You have to accept that one day—far in the future—you just might die.

- There is a legal cost associated with writing up a will and with estate planning.

Trust in trusts

The second component of a smart estate plan is often a trust. A trust is nothing more than a means of transferring property to a third party—the trust. Specifically, a trust lets you transfer title of your assets to trustees for the benefit of the people you want to take care of—aka your selected beneficiaries. The trustee will carry out your wishes on behalf of your beneficiaries.

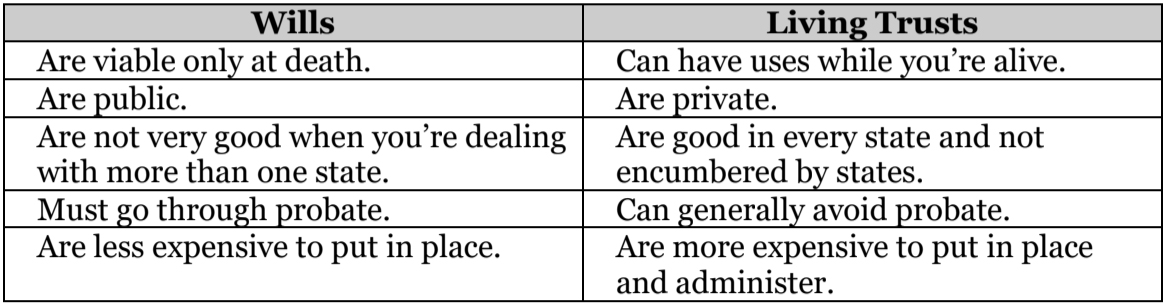

Wills and Trust Compared

Broadly speaking, there are two types of trusts: living (established while you are alive) and testamentary (created by your will after you’ve passed). Living trusts are becoming more and more popular to avoid the cost of probate. In the probate process, your representatives “prove” the validity of your will. The probate process also gives any creditors the opportunity to collect their due before your estate is passed to your heirs. There may be a long delay in settling your estate as it goes through probate. To add salt to the wound, probate can be costly.

A living trust can avoid or mitigate the effects of probate. It is a revocable trust that you establish and of which you are also typically the sole trustee. The assets in your living trust avoid probate at death, and are instead distributed to your heirs according to your wishes.

Living trusts are sometimes said to be superior to a will, but that is certainly not the case for everyone. It’s important that you understand how they compare.

Is a Living Trust for You?

It depends on your particular situation.

- Are your beneficiaries unwilling or unable to handle the responsibilities of an outright gift (investing the assets, spending the gift wisely, etc.)?

- Do you want to keep the amount and the ways your assets are distributed to heirs a secret?

- Do you want to delay or restrict the ownership of the assets by the beneficiary?

- Do you need to provide protection from your and/or your beneficiary’s creditors and plaintiffs?

- Do you want to lower your estate taxes?

Nevertheless, you should certainly consider it in consultation with your advisor or wealth manager. If you answered “yes” to any of the five questions, you may find it beneficial to set up a trust.

Your Next Move

We recommend that your estate plan be reviewed every year or two. The review should be conducted by a high-caliber wealth manager or tax professional—one who takes the time to learn what’s changed since you put your solutions in place, assess how those changes might impact your strategy, and make recommendations for getting your solutions current and in accordance with your wishes.

Capital Developers, LLC dba Milestone Wealth Information is registered as an investment adviser and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators and does not mean that the adviser has attained a particular level of skill or ability.

All expressions of opinion reflect the judgment of the author on the date of publication and are subject to change. Content should not be viewed as personalized investment advice or as an offer to buy or sell the securities discussed. A professional adviser should be consulted before implementing any of the strategies presented. Content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. The firm is not engaged in the practice of law or accounting.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s investment portfolio.